7 Best Travel Budgeting Apps Reviewed

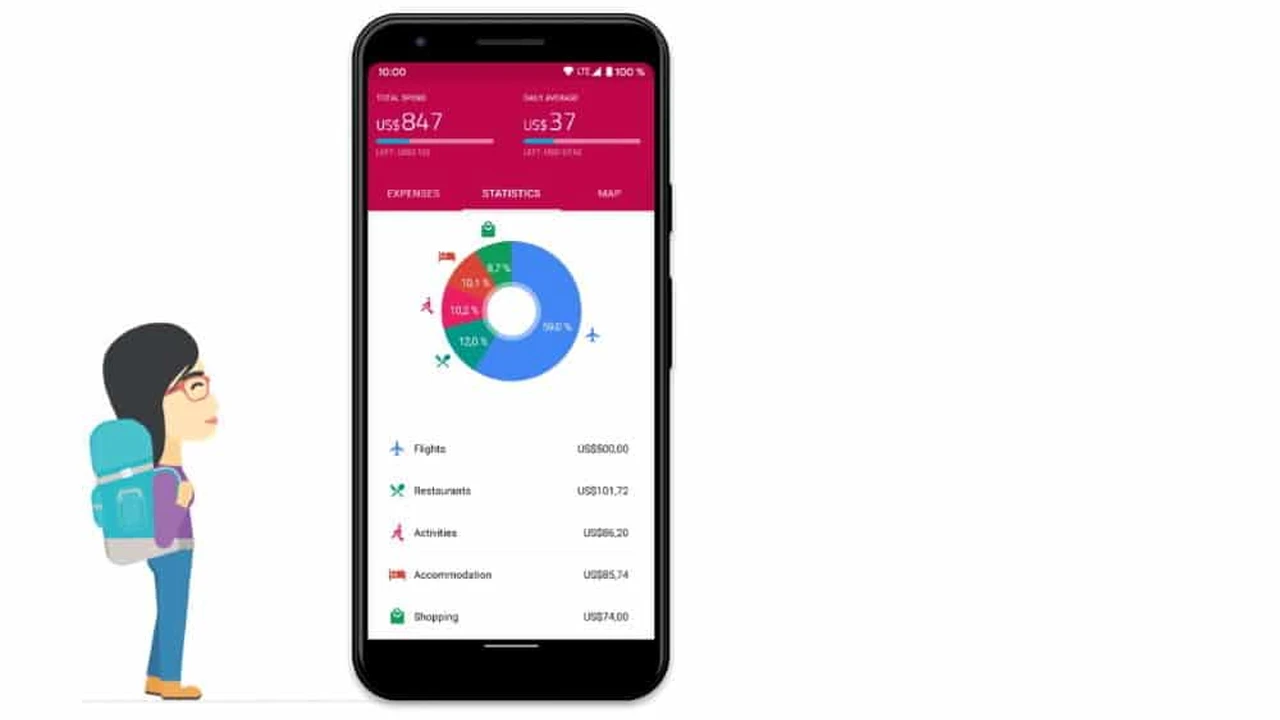

Compare the top travel budgeting apps for managing your finances on the go. Track your expenses, set spending limits, and monitor currency exchange rates. Stay in control of your budget with these helpful tools.

Why You Need a Travel Budgeting App

Let's face it, keeping track of your money while you're jet-setting around the world can be a real headache. Between converting currencies, remembering what you spent on that amazing Pad Thai, and trying not to accidentally drain your bank account, it's easy to lose track. That's where travel budgeting apps come in! They're like your personal finance guru in your pocket, helping you stay on top of your spending and avoid any nasty surprises.

Think of it this way: a travel budgeting app is more than just a way to record expenses. It's a tool that empowers you to make informed decisions about your spending, ensuring you can stretch your budget further and enjoy your trip without constantly worrying about running out of cash. Plus, with features like currency conversion, expense categorization, and spending reports, these apps can give you valuable insights into your spending habits, helping you become a more financially savvy traveler.

Key Features to Look for in Travel Budgeting Apps

Not all travel budgeting apps are created equal. Some are simple expense trackers, while others offer a more comprehensive suite of features. Here's what you should look for when choosing the right app for your needs:

- Expense Tracking: This is the core function of any budgeting app. You should be able to easily record your expenses, either manually or automatically by linking your bank accounts and credit cards.

- Currency Conversion: Essential for international travel, this feature automatically converts expenses to your home currency, so you can easily see how much you're spending.

- Expense Categorization: Group your expenses into categories like accommodation, food, transportation, and activities to see where your money is going.

- Budget Setting: Set daily, weekly, or monthly budgets for different categories to stay within your spending limits.

- Spending Reports: Get visual representations of your spending habits with charts and graphs, showing you where you're overspending and where you can save money.

- Offline Access: Crucial for when you're traveling in areas with limited internet connectivity.

- Multi-Currency Support: Allows you to track expenses in multiple currencies simultaneously.

- Cloud Syncing: Backs up your data to the cloud, so you can access it from multiple devices and avoid losing your information if your phone gets lost or stolen.

The 7 Best Travel Budgeting Apps: A Detailed Review

Okay, let's dive into the apps themselves! Here's a rundown of seven of the best travel budgeting apps available, with a focus on features, pricing, and suitability for different types of travelers.

1. Mint: The All-Around Budgeting Powerhouse

Description: Mint is a well-established personal finance app that also works great for travel budgeting. It automatically syncs with your bank accounts and credit cards, categorizes your transactions, and provides detailed spending reports. It's a solid choice if you want an all-in-one solution for both personal and travel finance.

Key Features:

- Automatic transaction syncing

- Bill tracking and reminders

- Credit score monitoring

- Budgeting tools

- Investment tracking

Pros: Free, comprehensive features, user-friendly interface.

Cons: Can be overwhelming with its many features, requires linking bank accounts (which some people are hesitant to do).

Pricing: Free

Best For: Travelers who want a comprehensive budgeting solution and are comfortable linking their bank accounts.

2. Trail Wallet: The Simple & Effective Tracker

Description: Trail Wallet is designed specifically for travelers who want a simple and easy-to-use expense tracker. It's focused on manual entry, which some people prefer for greater control over their data. It's perfect for backpacking trips where you want to minimize distractions and focus on your experiences.

Key Features:

- Manual expense entry

- Categorization of expenses

- Daily budget calculation

- Trip summaries

- Offline access

Pros: Simple interface, no bank account linking required, excellent for manual tracking.

Cons: Requires manual entry, limited features compared to other apps.

Pricing: Free for the first 25 entries, then a one-time purchase of $5.99 for unlimited entries.

Best For: Backpackers and budget travelers who prefer manual expense tracking and want a simple, distraction-free app.

3. Trabee Pocket: The Visual Budgeting App

Description: Trabee Pocket is a visually appealing app that focuses on categorizing expenses with colorful icons and charts. It's great for visual learners who want to see where their money is going at a glance.

Key Features:

- Visual expense categorization

- Currency conversion

- Trip summaries

- Budget setting

- Offline access

Pros: Visually appealing, easy to understand spending patterns, good for tracking multiple trips.

Cons: Limited features compared to other apps, manual entry required.

Pricing: Free with ads, or $2.99 to remove ads.

Best For: Visual learners who want a simple and visually appealing expense tracker.

4. Wallet: The Powerful Budgeting Tool

Description: Wallet is a powerful budgeting app that offers a wide range of features, including automatic bank syncing, budgeting tools, and financial planning capabilities. It's a good choice for travelers who want a more comprehensive budgeting solution.

Key Features:

- Automatic bank syncing

- Budgeting tools

- Financial planning

- Shared accounts

- Receipt scanning

Pros: Comprehensive features, automatic bank syncing, good for long-term financial planning.

Cons: Can be overwhelming with its many features, requires linking bank accounts.

Pricing: Free version available, premium version with more features starts at $14.99/year.

Best For: Travelers who want a powerful budgeting tool and are comfortable linking their bank accounts.

5. Spendee: The Stylish Expense Tracker

Description: Spendee is a stylish and user-friendly expense tracker that focuses on visual representations of your spending. It offers both manual entry and automatic bank syncing, making it a versatile option for different types of travelers.

Key Features:

- Automatic bank syncing

- Manual expense entry

- Visual expense categorization

- Budgeting tools

- Shared wallets

Pros: Stylish interface, easy to use, offers both manual and automatic tracking.

Cons: Some features require a premium subscription.

Pricing: Free version available, premium version starts at $2.99/month.

Best For: Travelers who want a stylish and user-friendly expense tracker with both manual and automatic tracking options.

6. Goodbudget: The Envelope Budgeting App

Description: Goodbudget is based on the envelope budgeting system, where you allocate funds to different categories (envelopes) and track your spending within those categories. It's a great option for travelers who want a more hands-on approach to budgeting.

Key Features:

- Envelope budgeting system

- Debt tracking

- Goal setting

- Shared budgets

- Manual entry

Pros: Encourages mindful spending, good for couples or families traveling together.

Cons: Requires manual entry, can be time-consuming to set up.

Pricing: Free version available, premium version with more envelopes starts at $7/month.

Best For: Travelers who prefer the envelope budgeting system and want a more hands-on approach to managing their money.

7. Revolut: The Travel-Friendly Banking App

Description: While not strictly a budgeting app, Revolut is a travel-friendly banking app that offers multi-currency accounts, fee-free currency exchange, and expense tracking features. It's a great option for managing your money while traveling internationally.

Key Features:

- Multi-currency accounts

- Fee-free currency exchange

- Expense tracking

- Budgeting tools

- Travel insurance

Pros: Excellent for international travel, fee-free currency exchange, convenient for managing multiple currencies.

Cons: Requires opening a Revolut account, limited features compared to dedicated budgeting apps.

Pricing: Free standard account, premium accounts with more features available for a monthly fee.

Best For: Travelers who want a convenient way to manage their money while traveling internationally and avoid currency exchange fees.

Product Comparisons: Choosing the Right App for You

Alright, so you've seen the apps, but how do you choose the *right* one for *you*? Let's break down some key comparisons:

Manual Entry vs. Automatic Syncing: Which is Better?

This is a big one. Manual entry apps like Trail Wallet give you complete control over your data, forcing you to be mindful of every expense. However, it can be time-consuming. Automatic syncing apps like Mint and Wallet are super convenient, but require you to trust them with your bank account information. Consider your comfort level and how much time you want to dedicate to tracking.

Free vs. Paid: Do You Need Premium Features?

Many apps offer free versions with basic features. These are often sufficient for casual travelers. However, if you want more advanced features like shared budgets, debt tracking, or ad-free experiences, you might consider a premium subscription. Evaluate your needs and budget accordingly.

Visual vs. Data-Driven: How Do You Prefer to See Your Spending?

Apps like Trabee Pocket focus on visual representations of your spending, making it easy to see where your money is going at a glance. Other apps like Mint provide more detailed data and reports. Choose an app that aligns with your preferred learning style.

Real-World Usage Scenarios: How These Apps Can Help

Let's look at some specific scenarios and how these apps can help you manage your budget:

- Backpacking Southeast Asia: Trail Wallet is perfect for keeping track of your daily expenses, especially when you're hopping between countries and dealing with different currencies.

- Family Trip to Europe: Goodbudget can help you allocate funds for different activities and track spending as a family, ensuring you stay within your overall budget.

- Business Trip to the US: Mint or Wallet can help you track your expenses and generate reports for reimbursement purposes.

- Long-Term Travel: Revolut can help you manage multiple currencies and avoid currency exchange fees, saving you money over the long haul.

Specific Product Recommendations and Pricing

Here are some specific product recommendations and their current pricing (as of October 2024 - prices may vary):

- Travel Adapter: The BESTEK Universal Travel Adapter (around $30 on Amazon) is a must-have for charging your devices in different countries. It supports multiple plug types and has surge protection.

- Portable Charger: The Anker PowerCore 20100mAh Portable Charger (around $40 on Amazon) will keep your phone and other devices charged on the go. It's compact and powerful enough to recharge your phone multiple times.

- Noise-Canceling Headphones: The Sony WH-1000XM5 Noise Canceling Headphones (around $400 on Amazon) are a lifesaver on long flights and noisy buses. They block out distractions and allow you to relax and enjoy your music or podcasts. A more budget-friendly option is the Anker Soundcore Life Q30 (around $80 on Amazon).

- Travel Backpack: The Osprey Farpoint 40 Travel Backpack (around $160 on Amazon) is a comfortable and versatile backpack that's perfect for backpacking trips. It has a padded hip belt and shoulder straps, and it's carry-on compatible.

Final Thoughts: Choose the App That Fits Your Style

Ultimately, the best travel budgeting app is the one that you'll actually use consistently. Take some time to explore the different options, try out a few free trials, and find the app that fits your needs and style. Happy travels, and happy budgeting!

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)